|

|

|

PyEmofUCSample project: CountyCityJ.M. Drake, P. López Martínez and C. CuevasSoftware

Engineering and Real-Time (ISTR) - University

of Cantabria

|

|

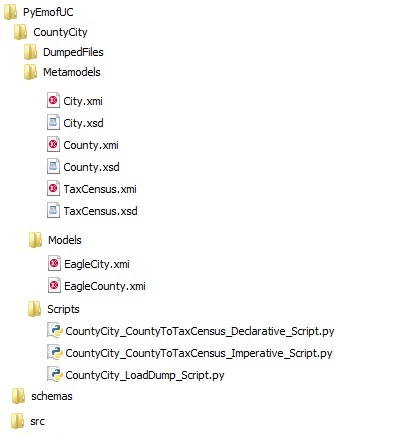

PyEmofUC => Root folder

that results from unpacking the PyEmofUC_0_0.zip

archive. It represents the starting point for the

inner relative paths. CountyCity => Root folder for the CountyCity sample project. DumpedFiles => Folder containing those files generated at runtime. Its contents can be removed. Meta-models => Folder containing the meta-models (M2) of the example. City.xmi => The City meta-model in XMI format. City.xsd => W3C-Schema that drives the formulation of models compliant to the City meta-model. County.xmi => The County meta-model in XMI format. County.xsd => W3C-Schema that drives the formulation of models compliant to the County meta-model. TaxCensus.xmi => The TaxCensus meta-model in XMI format. TaxCensus.xsd => W3C-Schema that drives the formulation of models compliant to the TaxCensus meta-model. Models => Folder containing the models (M1) of the example. EagleCity.xmi => Sample model instance compliant to the City meta-model. EagleCounty.xmi => Sample model instance compliant to the County meta-model. Scripts => Folder containing the scripts of the example. CountyCity_CountyToTaxCensus_Declarative_Script.py => Script implementing a sample M2M transformation using a declarative style. CountyCity_CountyToTaxCensus_Imperative_Script.py => Script implementing a sample M2M transformation using an imperative style. CountyCity_LoadDump_Script.py => Script implementing a model loading/processing/serialization process. schemas => Folder containing general purpose W3C-Schemas required by the PyEmofUC environment for auxiliary tasks. EMOF.xsd => Schema for EmofUC meta-models. It is referenced for XML validation of any meta-model in XMI format. XMI.xsd => Schema of the OMG XMI. It is imported by any meta-model in XMI format. src => Root folder containing the PyEmof Python code. Its path should be included in the PYTHONPATH environment variable. |

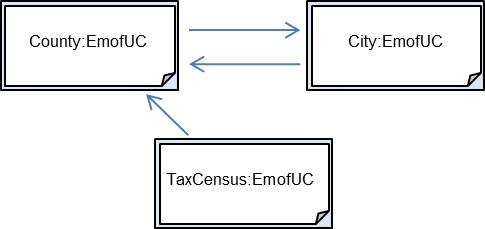

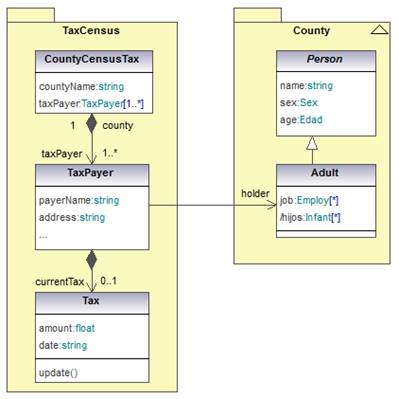

The County.xmi

file

formulates

the County

meta-model in XMI format, while the County.txt file formulates the same meta-model in

plain text.

Finally, the County.rtf

file formulates it in a enhanced (coloured) textual

format. When the County

meta-model is saved, it generates the

W3C-Schema County.xsd

(TODO) defining the XMI

files as well as the County.bnf BNF grammar (TODO) supporting the models

in the RTF format.

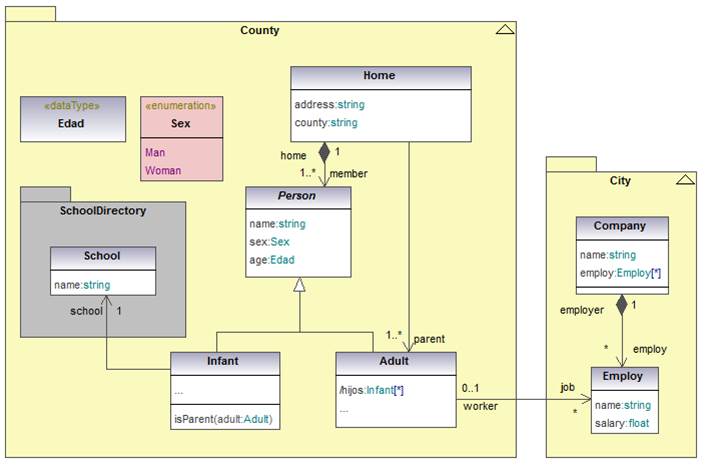

Each company has a workforce consisting of a set of jobs (Employ class). Each job may be assigned to an employee (worker) who must bte an adult (Adult) whose personal data are described in a model compliant to the County meta-model.

The City.xmi

file formulates the City

meta-model in XMI format, while the City.txt file formulates the same meta-model in plain

text.

Finally, the City.rtf

file formulates it in a enhanced (coloured) textual format.

Each debt has two data: the amount due (amount) and the date (date):

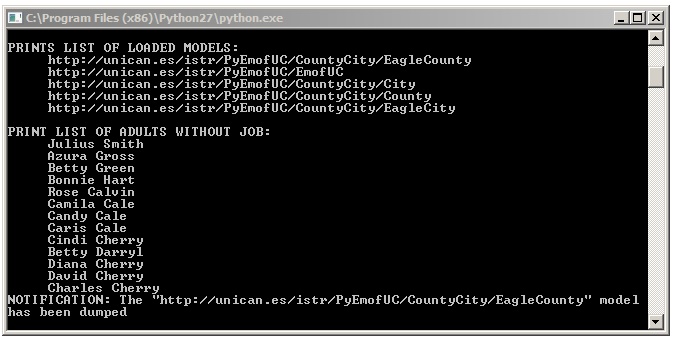

The table below shows the script with the Python code.

|

import

pyEmofUC.resource as resource import

pyEmofUC.xmlcore as xmlcore import

pyEmofUC.GLOBAL as GLOBAL xmlcore.PLATFORM

= 'C:\CountyCityWorkspace' # Set

VERBOSE MODE GLOBAL.IS_VERBOSE

= True # CountyCity

metamodel URIs countyURI = "http://unican.es/istr/PyEmofUC/CountyCity/County" cityURI = "http://unican.es/istr/PyEmofUC/CountyCity/Cyty" # The

application repository is built aRep =

resource.AppRepository() # Loads the

EagleCity model eagleCounty_URL

= "platform:CountyCity/models/EagleCounty.xmi" eagleCounty =

aRep.loadModel(eagleCounty_URL) # Example of

model managing: Displays the loaded models print '\n' + 'PRINTS

LIST

OF LOADED MODELS:' for

loadedModelURI in aRep.mdlRepositories.keys(): print 5 * ' ' +

loadedModelURI # Example of

model processing: List the name of adults without

job print '\n' + 'PRINT

LIST

OF ADULTS WITHOUT JOB:' adultWithoutJob

= (adult for home in eagleCounty.rootPackage.home

for adult in home.member

if adult.isInstanceOf('cnty.Adult') and not adult.job) for theAdult in

adultWithoutJob: print 5 * ' ' +

theAdult.name # Dumps

eagleCounty model with RTF format dumpedEagleCounty_URL

= 'platform:CountyCity/DumpedFiles/EagleCounty.rtf' eagleCounty.dump(dumpedEagleCounty_URL) # Delete all

models del aRep |

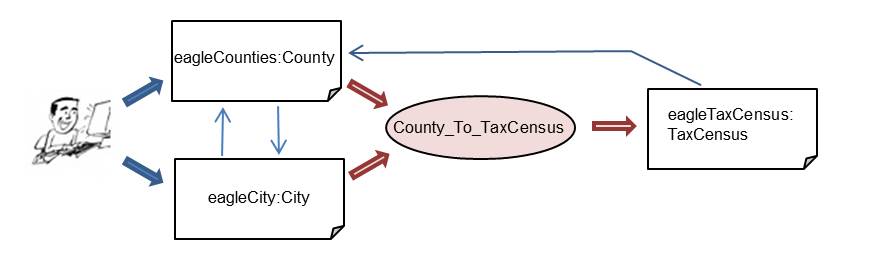

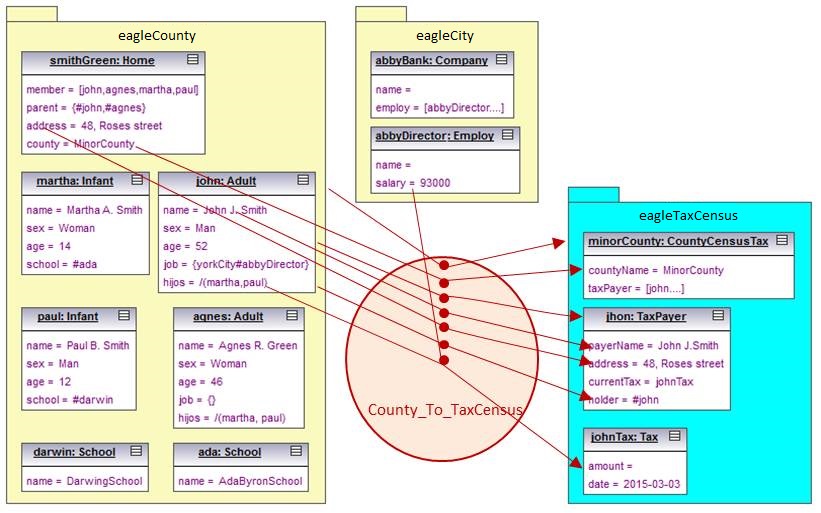

Since the input model references to a City model, loading it implies loading that second one.

|

# @nsURI

county_MM=http://unican.es/istr/PyEmofUC/CountyCity/County # @nsURI taxCensus_MM=

http://unican.es/istr/PyEmofUC/CountyCity/TaxCensus module County_To_TaxCensus; create outTaxCensusModel

: taxCensus_MM from inCountyModel

: county_MM; helper def :

rootContainer() : county_MM!County = . . .; helper def :

currentDate() : String = . . .; helper def :

accumulatedSalary(theAdult: county_MM!Adult) : Real= . . .; lazy rule createTax

{ from theAdult

: county_MM!Adult to theTax

: TaxCensus!Tax ( amount <- (0.2 * accumulatedSalary(theAdult)) – (100.0

* len(theAdult.offspring)), date <- thisModule.currentDate() ) } entrypoint rule County_To_TaxCensus

() { to theCountyTaxCensus

: taxCensus_MM!CountyTaxCensus( countyName <- thisModule.rootContainer().countyName, taxPayer <- thisModule.rootContainer().home -> collect(theHome |

theHome.member -> select(theMember |

theMember.isInstanceOf(County_MM!Adult)) ) ) } rule Adult_To_TaxPayer

{ from theAdult

: county_MM!Adult to theTaxPayer

: taxCensus_MM!TaxPayer ( payerName <- theAdult.name, address <- theAdult.home.address+

’ ‘ + thisModule.rootContainer().countyAddress, currentTax <- if

not theAdult.job

-> isEmpty() then thisModule.createTax(theAdult), else OclUndefined

endif, holder <- theAdult } |

county_MM represents the URI of the

County meta-model taxCensus_MM represents the URI of

the TaxCensus

meta-model The module County_To_TaxCensus

represents the generation of the outTaxCensusModel

model from the inCountyModel model Returns the input model main

container. Returns the

date of the invocation instant Returns the

accumulated salary of the Adult element as

the sum of the salaries corresponding to

the jobs assigned to him/her. Callable rule which generates an

element of Tax type in the output model using the data

of the referenced Adult element Initial rule which generates the output

model main container using the

data in the input model Rule which generates a TaxPayer

element in the output model for each Adult element

in the input model |

The County_To_TaxCensus_Declarative.py file contains the transformation Python code in a declarative style.

|

Python code |

ATL code |

||

|

import emofUC.resource as resource import emofUC.xmlcore as xmlcore import emofUC.GLOBAL as GLOBAL aRep

= resource.AppRepository() xmlcore.PLATFORM = "C:\Users\. .

.\PyEMOF_UC\Workspace" |

|

||

|

|

@path

county_MM_URL= platform:CountyCity/County.xmi @ path

taxCensus_MM_URL= platform:CountyCity/TaxCensus.xmi |

||

|

county_MM_URL = 'platform:CountyCity/County.xmi' taxCensus_MM_URL

= 'platform:CountyCity/TaxCensus.xmi' aRep.loadModel(taxCensus_MM_URL) |

|

||

|

|

module CountyCity_To_TaxCensus; create outTaxCensusModel : taxCensus_MM from inCountyModel : county_MM; |

||

|

outTaxCensusModelURI = "http://unican.es/istr/PyEmofUC/CountyCity/EagleTaxCensus" outTaxCensusModelNsPrefix

= 'etxc' outTaxCensusModel

= aRep.createMdlRepository(uri=outTaxCensusModelURI,

mmUrl=taxCensus_MM_URL,

nsPrefix=outTaxCensusModelNsPrefix) inCountyModelURL

= "platform:CountyCity/EagleCounty.xmi" inCountyModel = aRep.loadModel(inCountyModelURL) |

|

||

|

|

helper def :

rootContainer() : county_MM!County = . . .; |

||

|

def rootContainer(): return inCountyModel.rootPackage |

|

||

|

|

helper def :

currentDate() : String = . . .; |

||

|

def currentDate(): return GLOBAL.currentDate() |

|

||

|

|

helper def :

accumulatedSalary(theAdult: county_MM!Adult) : Real= .

. .; |

||

|

def accumulatedSalary(theAdult): return reduce(lambda x, y:x +

y, [job.salary for job in theAdult.job]) |

|

||

|

|

lazy rule createTax

{ from theAdult

: county_MM!Adult to theTax

: TaxCensus!Tax ( amount <- (0.2 * accumulatedSalary(theAdult)) – (100.0

* len(theAdult.offspring)), date <- thisModule.currentDate() ) } |

||

|

def createTax(theAdult): if len(theAdult.job)

> 0: theTax

= outTaxCensusModel.createElement('txc.Tax',

theAdult.xmi_id.replace('cnty', 'etxc') + '.theTax') theTax.amount

= (0.2 *

accumulatedSalary(theAdult)) - (100.0 *

len(theAdult.offspring)) theTax.date

= currentDate() return theTax else: return None |

|

||

|

|

entrypoint rule County_To_TaxCensus

() { to theCountyTaxCensus

: taxCensus_MM!CountyTaxCensus( countyName <- thisModule.rootContainer().countyName, taxPayer <- thisModule.rootContainer().home -> collect(theHome |

theHome.member -> select(theMember |

theMember.isInstanceOf(County_MM!Adult)) ) ) } |

||

|

theCounty

= rootContainer() theCountyTaxCensus

= outTaxCensusModel.createElement('txc.CountyTaxCensus',

rootContainer().xmi_id.replace('cnty', 'etxc')) theCountyTaxCensus.countyName

= rootContainer().countyName theCountyTaxCensus.taxPayer = [theMember.xmi_id.replace('cnty', 'etxc') + '.theTaxPayer' for theHome in rootContainer().home for theMember intheHome.member if theMember.isInstanceOf('cnty.Adult')] |

|

||

|

|

rule Adult_To_TaxPayer

{ from theAdult :

county_MM!Adult to theTaxPayer :

taxCensus_MM!TaxPayer ( payerName <- theAdult.name, address <- theAdult.home.address+

’ ‘ + thisModule.rootContainer().countyAddress, currentTax <- thisModule.createTax(theAdult), holder <- theAdult } |

||

|

for theAdult in (theAdult for theAdult in inCountyModel.getElements() if theAdult.isInstanceOf('cnty.Adult')): theTaxPayer

= outTaxCensusModel.createElement('txc.TaxPayer',

theAdult.xmi_id.replace('cnty', 'etxc') + '.theTaxPayer') theTaxPayer.payerName

= theAdult.name theTaxPayer.address

= theAdult.home.address + ' ' +

inCountyModel.rootPackage.countyAddress theTaxPayer.holder

= theAdult theTaxPayer.currentTax = createTax(theAdult) |

|

||

|

|

#Updating of references

between objects created in the output model

|

||

|

outTaxCensusModel.rootPackage

= theCountyTaxCensus theCountyTaxCensus.taxPayer = [outTaxCensusModel.getElement(xmiid)

for xmiid in theCountyTaxCensus.taxPayer] |

|

||

The output model generated by the County_To_TaxCensus

transformation

can be found in the EagleTaxCensus_Declarative.xmi

file.

Transformation

formulation (imperative style):

The table below shows the

County_To_TaxCensus M2M transformation in an

imperative style.

The imperative algorithm is based on an iteration over the input model elements, using conditional sentences to evaluate the guard conditions.

For the appropriate elements, their attributes are processed and the corresponding output model elements are created.

|

1. Creates an

application repository to store and process the

models. 2. Opens the input file

and loads the in the repository the model data. 3. Load the metamodel

of the output model 4. Creates an empty

output model 5. Creates the root

container element of the output model. 5.1. Assigns the

attributes of the output model head. 5.2. FOR each element Adult

in the input model, creates a TaxPayer element in

the output model. 5.2.1. Assigns value to the

attributes of the created TaxPayer element. 5.2.2. IF the Adult element

has referenced jobs: 5.2.2.1. Creates a Tax

element and assigns the values to the attributes. 5.2.2.2. Aggregates the created element (or

None if is not created) to the TaxPayer element. |

|

Python code |

Pseudocode |

||

|

|

1. Creates an application

repository to store and process the models. |

||

|

import emofUC.resource as resource import emofUC.xmlcore as xmlcore import emofUC.GLOBAL as GLOBAL aRep

= resource.AppRepository() xmlcore.PLATFORM = "C:\Users\. .

.\PyEMOF_UC\Workspace" |

|

||

|

|

2. Opens the input file and loads

the in the repository the model data. |

||

|

inCountyModelURL = "platform:CountyCity/EagleCounty.xmi" inCountyModel = aRep.loadModel(inCountyModelURL) |

|

||

|

|

3. Load the metamodel of the

output model. |

||

|

taxCensus_MM_URL = 'platform:CountyCity/TaxCensus.xmi' |

|

||

|

|

4. Creates an

empty output model |

||

|

aRep.loadModel(taxCensus_MM_URL) outTaxCensusModelURI

= "http://unican.es/istr/PyEmofUC/CountyCity/EagleTaxCensus" outTaxCensusModelNsPrefix

= 'etxc' outTaxCensusModel

= aRep.createMdlRepository( uri=outTaxCensusModelURI, mmUrl=taxCensus_MM_URL, nsPrefix=outTaxCensusModelNsPrefix) |

|

||

|

|

5. Creates

the root container element of the output model: |

||

|

rootContainer_xmiid = 'etxc.Id_' +

str(outTaxCensusModel.nextXmiId()) theCountyTaxCensus

= outTaxCensusModel.createElement( metaclass='txc.CountyTaxCensus', xmi_id=rootContainer_xmiid) outTaxCensusModel.rootPackage

= theCountyTaxCensus |

|

||

|

|

5.1 Assigns

the attributes of the output model head. |

||

|

theCountyTaxCensus.countyName =

inCountyModel.rootPackage.countyName |

|

||

|

|

5.2 FOR each element Adult in the

input model, creates a TaxPayer element in the

output model. |

||

|

for theAdult in (theAdult for theAdult in inCountyModel.getElements() if theAdult.isInstanceOf('cnty.Adult')): |

|

||

|

|

5.2.1.

Assigns value to the attributes of the created

TaxPayer element. |

||

|

theTaxPayer

= outTaxCensusModel.createElement('txc.TaxPayer', 'etxc.Id_' + str(outTaxCensusModel.nextXmiId())) theTaxPayer.payerName

= theAdult.name theTaxPayer.address

= theAdult.home.address + ' ' +

inCountyModel.rootPackage.countyAddress theTaxPayer.holder = theAdult |

|

||

|

|

5.2.2. IF the

Adult element has referenced jobs: |

||

|

theTax

= None if len(theAdult.job)

> 0: |

|

||

|

|

5.2.2.1. Creates

a Tax element and assigns the values to the

attributes. |

||

|

theTax

= outTaxCensusModel.createElement('txc.Tax', 'etxc.Id_' + str(outTaxCensusModel.nextXmiId())) theTax.amount

= -100.0 *

len(theAdult.offspring) for theJob in theAdult.job: theTax.amount

+= 0.2 *

theJob.salary theTax.date = GLOBAL.currentDate() |

|

||

|

|

5.2.2.2. Aggregates

the created element (or None if is not created) to

the TaxPayer element. |

||

|

theTaxPayer.currentTax

= theTax theCountyTaxCensus.taxPayer.append(theTaxPayer) |

|

||